LinkedIn is a crucial platform for financial institutions to build trust, humanize their brand, and connect authentically with a professional audience. By leveraging innovative content strategies tailored to financial services, brands can showcase expertise, foster relationships, and generate meaningful engagement. Here’s a breakdown of 10 engaging LinkedIn post ideas for financial brands—and why each works so well.

Why it works: These stories transform abstract financial services into real-world outcomes, helping prospects visualize success. They foster trust and credibility by highlighting tangible results, all while showing empathy and alignment with client goals. Localizing success stories based on region or audience segment boosts relatability and conversion.

Why it works: Financial literacy is a widespread need, and educational content positions your brand as a thought leader. It provides immediate value to your audience, nurtures long-term trust, and increases the likelihood that prospects will return to your page for future advice. Content that answers FAQs or simplifies complex processes performs exceptionally well in SEO and engagement.

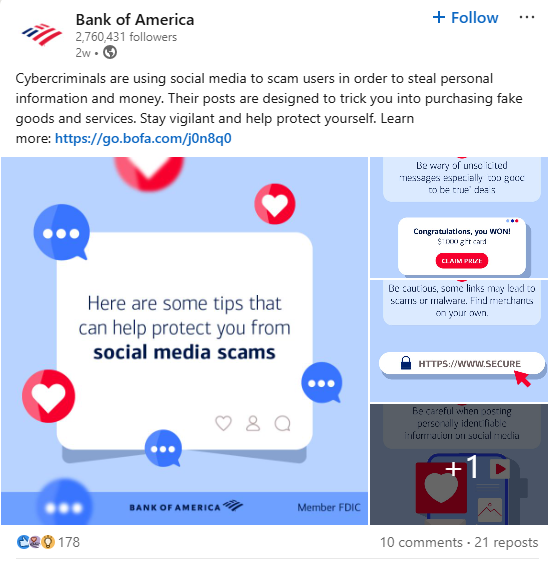

Example: This post from Bank of America is a perfect example of leveraging social media to educate its audience about finance-related concerns, particularly cybersecurity. Using eye-catching graphics and linking to an article in the caption, this post equips its audience with essential information to help them avoid being scammed.

Why it works: People connect with people. Employee features show the human side of your brand, build internal pride, and highlight diversity and talent. Spotlights are also excellent for talent acquisition, boosting employer branding while subtly reinforcing the professionalism behind your services.

Example: This post from Wells Fargo celebrating head of Equipment and Vendor Finance Amrita Patel’s Ascend A-List Award win is a perfect example of recognizing the achievements of its employees. Not only does this post spotlight the winner, but it also highlights the bank's credibility and validity in the eyes of its customers.

Why it works: Customers increasingly choose brands aligned with their values. Showcasing community service, nonprofit support, or local partnerships demonstrates corporate social responsibility and helps humanize your institution. Including local or regional elements improves engagement and enhances brand affinity.

Example: This Comerica Bank post highlights employees helping a local non-profit restore and plan critical habitats for pollinators, showing community engagement, volunteerism, and the bank’s commitment to giving back.

Why it works: While people tune out hard sells, they pay attention to new tools or services that solve real problems. Position your announcement with a clear value proposition and user benefit. Use approachable language and multimedia to make it digestible and shareable.

Why it works: Sharing data-backed insights positions your brand as a leader in financial intelligence, builds authority, and earns trust, especially among B2B clients and high-net-worth individuals who rely on strategic foresight. Evergreen topics with a news hook or seasonal relevance drive higher engagement and SEO value.

Example: Every week, Comerica Bank shares its Weekly Economic Report, highlighting industry trends and providing crucial financial analysis to its audience. The cadence provides the audience with frequent updates and gives them something to look for each week.

Why it works: These spark dialogue and turn passive scrollers into active participants. Engagement boosts visibility on LinkedIn, and the data you collect can inform future content, product decisions, or whitepapers. Keep it relevant and lightweight to maximize interaction.

Why it works: Transparency builds trust. A sneak peek into daily operations, office culture, or team celebrations makes your brand feel approachable and genuine. This content is beneficial for differentiating your institution in a crowded, often conservative industry.

Why it works: Long-form content provides depth and showcases expertise. It’s ideal for complex financial topics that require more than a headline to explain. When optimized correctly, thought leadership pieces perform well in search and can be repurposed across newsletters, client decks, or webinars.

Why it works: Social proof is powerful. When real clients endorse your services, it reduces skepticism and builds immediate trust. Use quotes, short videos, or case summaries to bring these testimonials to life. Consider tagging the client (with permission) to extend your post’s reach.

Example: This post from PNC Bank spotlights Christy White of WhirlyBird Granola, one of its small business customers. Showing real-world examples, told straight from the customer, adds validity and credibility to PNC’s marketing message, encouraging other small business owners to trust the bank with their finances.

Try these LinkedIn post ideas for financial brands to start increasing engagement and building trust with your audience. Are you a financial brand looking to improve its LinkedIn presence? Contact Random today to book a discovery call!